By Move or Improve UK

Quick Summary

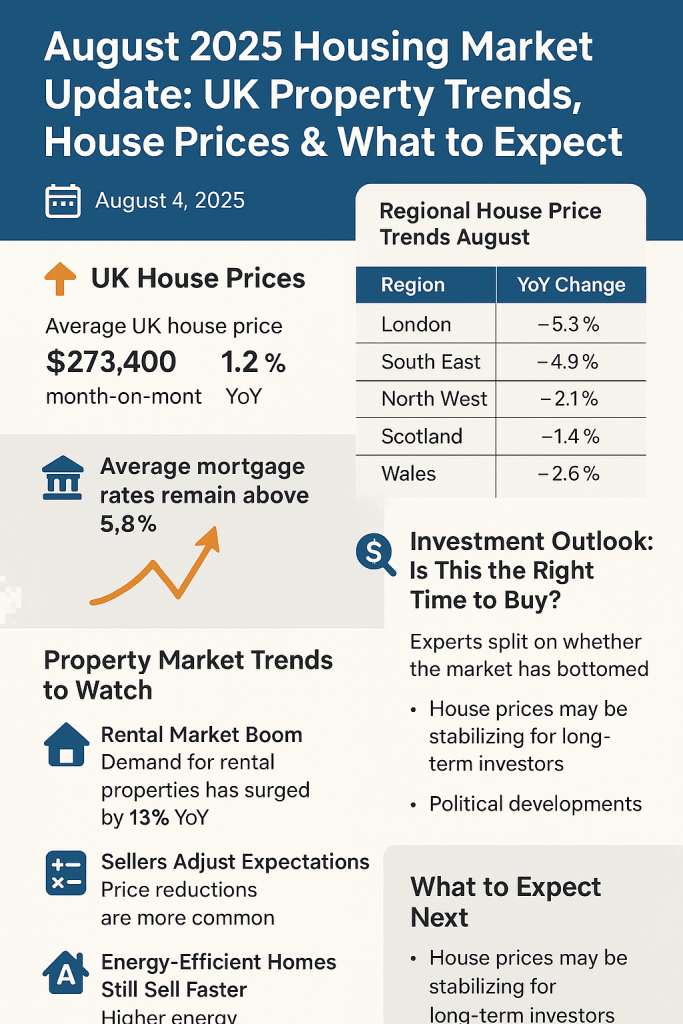

- UK house prices fall 1.2% month-on-month amid economic uncertainty.

- Mortgage rates remain high, impacting buyer affordability.

- London and South-East lead the decline in transaction volumes.

- Demand for rental properties surges amid stagnant wages.

- Experts split on whether we’ve hit the bottom of the market.

UK House Prices: Are We at the Bottom?

As of August 2025, the average UK house price stands at £273,400, marking a 1.2% decline from July and a 4.7% drop year-on-year, according to Nationwide and Halifax reports.

Regional House Price Trends (August 2025):

| Region | YoY Change (%) | Avg. Price (£) |

| London | -5.3% | 514,200 |

| South East | -4.9% | 372,800 |

| North West | -2.1% | 213,400 |

| Scotland | -1.4% | 193,700 |

| Wales | -2.6% | 215,100 |

Mortgage Rates & Lending: A Tough Climate Persists

Average mortgage rates in August 2025 remain above 5.8% for a 5-year fixed deal, causing affordability constraints—especially for first-time buyers and buy-to-let landlords.

What’s Fuelling the Market Slowdown?

- High interest rates from the Bank of England (base rate currently at 4.75%)

- Cost-of-living pressures and flatlining wages

- Post-pandemic backlog in property completions

- Uncertainty ahead of the Autumn Budget 2025

Property Market Trends to Watch

1. Rental Market Boom

With would-be buyers priced out, demand for rental properties has surged by 13% year-on-year. Rental prices in cities like Manchester, Bristol, and Leeds are now at record highs, driving investor attention despite higher borrowing costs.

Search trend keywords: UK rental crisis 2025, rental price increase UK, buy-to-let 2025

2. Sellers Adjust Expectations

Sellers are becoming more realistic, with the average time on market now at 58 days—up from 39 days in early 2024. Price reductions are more common, and the era of over-asking offers seems firmly over.

3. Energy-Efficient Homes Still Sell Faster

Despite the slowdown, A-rated EPC homes sell 22% faster and command up to £15,000 premium. Green mortgage incentives are also influencing buyer decisions.

Investment Outlook: Is This the Right Time to Buy?

Property analysts remain divided:

- Bullish view: Prices are stabilising, creating opportunity for long-term investors.

- Bearish view: More downside likely if interest rates stay elevated into 2026.

“We’re seeing a correction, not a crash. The fundamentals remain strong, but the era of cheap money is behind us.” – Dr. Nina Walsh, UK Property Economist

What to Expect Next: UK Housing Market Forecast

Looking ahead to Q4 2025, experts forecast:

- House prices may bottom out by December if the Bank of England signals rate cuts.

- Rental market pressures will remain, particularly in urban hubs.

- Political developments, including the anticipated General Election, could inject new momentum or caution.

Final Word

The UK property market in August 2025 is defined by caution, recalibration, and resilience. While headlines focus on falling prices, savvy buyers and long-term investors are quietly preparing to re-enter. For sellers and agents, pricing realistically and focusing on energy efficiency remains crucial.

🏡 Stay Informed: Sign Up for our Housing Market Alerts

Don’t miss critical updates; The #1 trusted source for property news, forecasts, and expert insights.

✅ Key Takeaways

- UK house prices down 4.7% YoY

- Mortgage rates above 5.8%

- Rental demand hits new highs

- Energy-efficient homes outperform

- Market likely to stabilise by year-end

📢 Press & Media Enquiries: For expert interviews, commentary, or custom data insights, please contact: architectmoveorimprove@gmail.com

Discover more from Move or Improve

Subscribe to get the latest posts sent to your email.

Leave a comment