The UK property market enters Q4 2025 with measured confidence. Prices are inching upward, buyers are cautiously returning, and lending conditions are stable but still shaped by higher borrowing costs.

With the Autumn Budget approaching, all eyes are on what fiscal adjustments could mean for homeowners, landlords and investors alike.

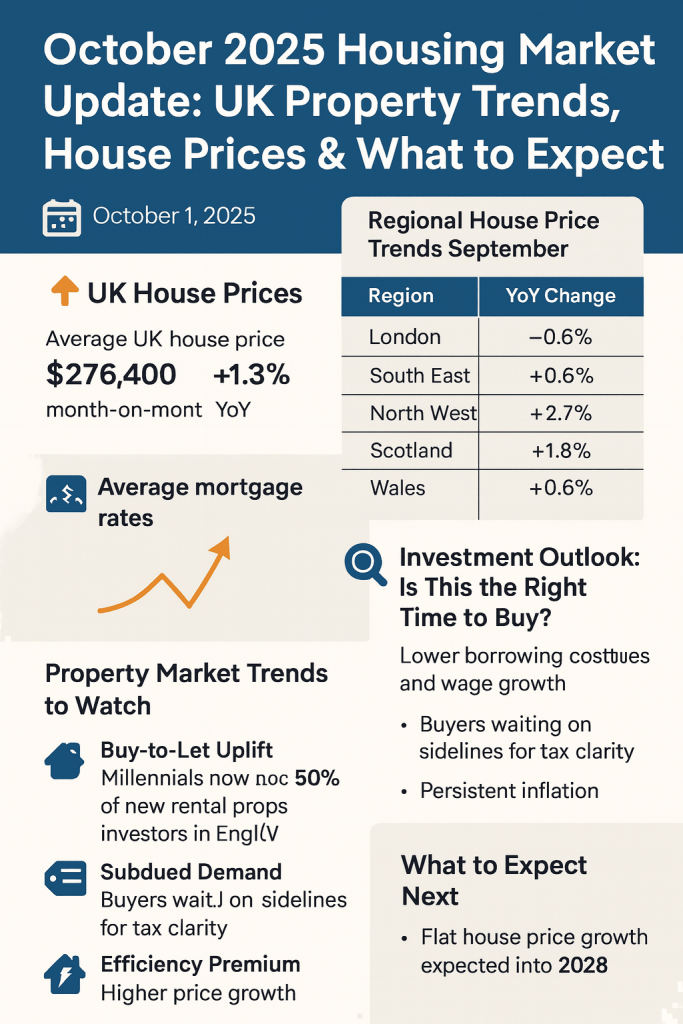

UK House Prices; Current State

- Average UK house prices have risen by around 2.8% year-on-year, bringing the national average to approximately £271,000. Growth remains modest and uneven.

- Northern regions such as the North East, North West and Northern Ireland continue to outperform.

- London and the South East are showing marginal gains, reflecting affordability ceilings and more sub-dued buyer demand.

- The market is stabilising after the volatility of 2022 – 2024, moving toward a sustainable rhythm rather than a boom-and-bust cycle.

Overall, price growth remains positive but controlled; a sign of resilience amid tighter credit conditions and lingering inflationary pressures.

Mortgage Rates & Lending

Mortgage rates remain one of the key dampers on activity. The average two- and five-year fixed rate sits near 4.9–5.0%, with lenders competing slightly on longer-term stability rather than headline rates:

- While the Bank of England’s rate cuts in mid-2025 provided some relief, margins remain sticky.

- Lending volumes are holding steady, supported by greater product choice and a cautious return of first-time buyers.

- Buy-to-let markets remain squeezed, with landlords facing tighter yield margins and shifting regulatory landscapes.

Affordability remains the defining challenge but easing inflation and slow wage growth improvements suggest a steadier lending environment heading into 2026.

Property Market Trends to Watch

- Cautious Buyers Awaiting the Autumn Budget; Many are delaying major purchases until fiscal announcements clarify potential housing or tax incentives.

- Persistent Supply Shortages; Planning reforms have yet to unlock sufficient land or accelerate approvals, especially in London and the South East.

- Regional Realignment; Northern and Midlands cities are seeing renewed attention from both first-time buyers and investors seeking better value.

- Rising Rental Pressure; Limited rental supply continues to drive up rents, albeit at a slower pace than in 2024.

- Energy Efficiency & Retrofit Demand; Green mortgages and EPC upgrade schemes are influencing both buyer preferences and lender products.

Investment Outlook

For investors, 2025 has been a year of recalibration rather than retreat:

- Yields in high-value southern postcodes remain compressed, but secondary cities such as Birmingham, Leeds, and Glasgow are delivering healthier returns.

- Capital appreciation is expected to remain modest, so investors are focusing on cash flow and rental resilience.

- The institutional rental sector continues to grow, adding professional management and stability to the private rental landscape.

In short: property investment remains viable, but strategies now favour long-term fundamentals over speculative gains.

What to Expect Next – UK Housing Market Forecast

Analysts are broadly aligned on a flat-to-modest-growth outlook for the next year:

- Knight Frank expects around 1% growth across 2025.

Savills forecasts cumulative price growth of 24 – 25% over five years, though highly dependent on region.

- Transaction volumes are likely to remain subdued into early 2026, with gradual recovery as borrowing costs ease.

Key factors to watch:

- The Autumn Budget 2025, which may include housing or planning reforms.

- The pace of interest rate reductions and corresponding shifts in mortgage pricing.

- Inflation and wage growth alignment; essential for restoring affordability.

Final Word; Key Takeaways

The UK housing market of late 2025 feels calmer, steadier, and arguably healthier than it has in years.

Key Takeaways:

- Price growth remains positive but moderate, at around 2 – 3% annually.

Mortgage costs continue to shape buyer and investor decisions.

- Regional markets; particularly the North and Midlands offer the best blend of value and growth.

- Investors should prioritise yield stability and sustainability over short-term capital gain.

- Policy direction from the upcoming Autumn Budget could redefine confidence levels into 2026.

The message? Move or improve? but move wisely. In a maturing market, success belongs to those who plan strategically, balance affordability with ambition and think long-term.

Discover more from Move or Improve

Subscribe to get the latest posts sent to your email.

Leave a comment