As of February 2026, the UK housing market shows cautious signs of recovery with modest price increases, improving transaction volumes, and competitive mortgage rates. Demand for energy-efficient homes is rising, particularly in regional cities. Buyers and investors can expect balanced conditions and opportunities in the coming months.

January 2026 UK Housing Market Update: Prices & What to Expect

As of January 2026, the UK housing market is stabilizing after years of fluctuations, favoring a more strategic approach for buyers, sellers, and investors. Key trends include price regionalism, affordability as a primary driver, and strong rental demand. Success hinges on understanding local dynamics and realistic pricing.

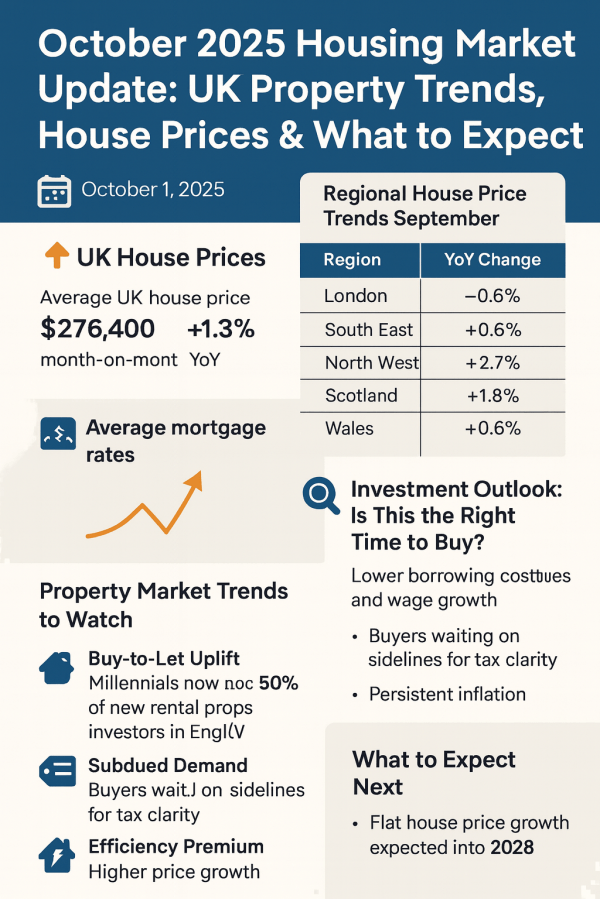

October 2025 Housing Market Update: UK Property Trends, House Prices & What to Expect

The UK property market enters Q4 2025 with measured confidence. Prices are inching upward, buyers are cautiously returning, and lending conditions are stable but still shaped by higher borrowing costs. With the Autumn Budget approaching, all eyes are on what fiscal adjustments could mean for homeowners, landlords and investors alike. UK House Prices; Current State... Continue Reading →

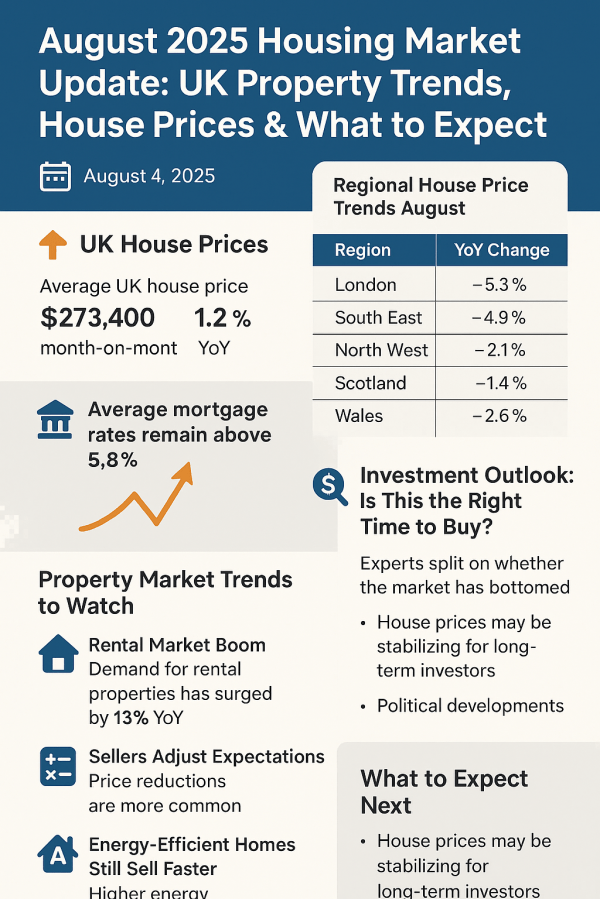

August 2025 Housing Market Update: UK Property Trends, House Prices & What to Expect

UK house prices fell 1.2% month-on-month in August 2025, reaching an average of £273,400. High mortgage rates above 5.8% strain buyer affordability, while rental demand surges by 13% year-on-year. Experts are uncertain about market stabilization, but energy-efficient homes continue to sell faster. Realistic expectations are vital for sellers.

May 2025: Housing Market Update: Trends, Insights & What to Expect

As of May 2025, the UK housing market displays signs of recovery with a 9% increase in property listings and inquiries. Policy changes are influencing buyer strategies, focusing on energy-efficient homes. Demand for flexible living spaces is rising, particularly in suburban areas. Moderate price growth is expected this summer, alongside a renovation boom.

February 2025 Housing Market Update: Trends, Insights & What to Expect

As we step into February 2025, the UK housing market remains a hot topic for buyers, sellers, and homeowners alike. With shifting economic conditions, evolving mortgage rates, and changing buyer preferences, it’s essential to stay informed. In this month’s Move or Improve newsletter, we’ll explore key trends shaping the market and offer expert insights to... Continue Reading →

2025 UK Housing Outlook: Key Changes and Insights

In 2025, the UK housing market shows promising growth influenced by rising house prices, anticipated interest rate cuts, and government initiatives such as stamp duty changes and ambitious housebuilding targets. Analysts predict modest price increases and improved transaction volumes, particularly in London, reflecting favorable economic conditions for buyers and investors.

Top Tips for Finding Your Dream Home

The post emphasizes that the post-Christmas period, particularly December 26, is crucial for real estate searches, as online activity significantly increases. With favorable market conditions like falling mortgage rates and rising wages, 2024 presents an ideal opportunity for buyers. Encouragement is given to start searching for homes today.

UK Property Prices Experience Slight Decline in 2024: Market Dynamics and Influencing Factors

UK property prices fluctuate due to factors like mortgage rates, supply, and demand post-pandemic, leading to stabilization.